COVID-19 Situation

Covid-19 pandemic is rapidly developing in Africa with number of countries, number of cases, and number of deaths all on the increase. Though the number of cases hasn’t reached the levels like in other countries such as China, Italy and the USA, studies show that devastating effects will be seen in this region as number of cases increase. According to WHO’s report on April 8, 2020, the total number of cases in Sub-Saharan Africa reached 5,554 cases, and 129 deaths. With this pandemic, greater risk is posed in this region where the healthcare system is rather fragile with low national budgets, inconsistent support from donor countries as well as relatively low numbers of healthcare workers.

Many of the countries have undertaken measures like border closure, lockdown and curfew to curb the situation. Ghana has lockdown its 3 major cities, the Greater Accra Metropolitan Area and the greater Kumasi Metropolitan Area, and Tema with limited intracity movement for three weeks. It has also closed all of its borders. South Africa has gone into a 21-day nationwide lockdown. Kenya has gone into a three week ban on movement in four affected areas including Nairobi and the port city of Mombasa along with its already imposed dusk-to-dawn curfew. Furthermore, it has suspended all international flights. Nigeria has closed two of its international airports and limited public transportations. With the border closures and lockdown, many countries still allow trade activities through sea, and land. Some countries like South Africa in particular, allows essential goods like rice, oil etc. to enter the country.

Current Palm Oil Situation

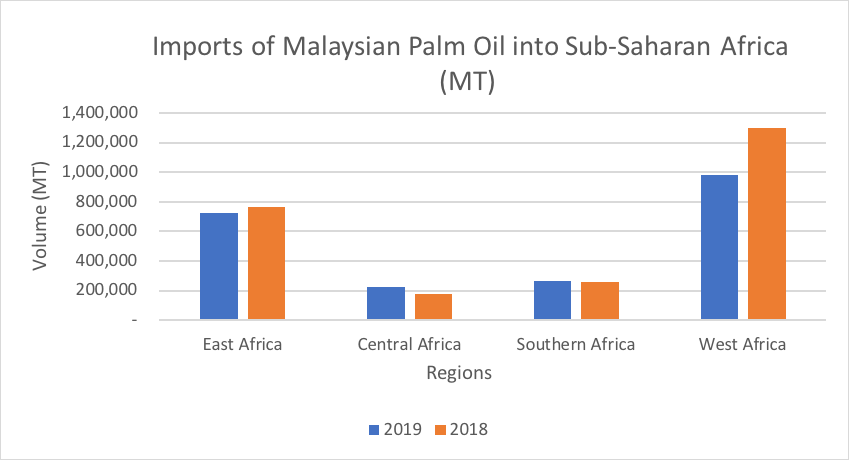

The demand for oils and fats in Sub-Saharan Africa has been increasing over the years. Estimated consumption of palm oil was at 6.9 million MT in 2019. While estimated production of palm oil reached only 1.3 million MT within Sub-Saharan Africa, this amount is not enough to fulfil the local demand. To fill this gap, Sub-Saharan Africa imports palm oil mainly from Malaysia and Indonesia. Malaysia exported a total of 2.2mil MT of palm oil in 2019 and 2.5 mil MT in 2018 to this region. Most of Malaysian palm oil imports goes into Western and Eastern regions. Malaysia’s biggest importing countries in 2019 include Nigeria, South Africa, Tanzania, Mozambique, Kenya, and Ghana.

Logistics

Many of the palm oil producing and palm oil importing countries in Sub-Saharan Africa have not seen any major disruption in their operations so far. Palm oil falls under essential goods and therefore trade through sea ports and land borders is still going on without much interruption. Some ports such as the port in Durban, South Africa has closed part of their berths, and due to higher safety precautions at the port, the clearance process is slightly slower than usual.

HORECA

Bulk palm oil trading in countries such as Nigeria, Ghana and South Africa will see the effect of lockdown soon since schools are closed, and large gatherings are prohibited. Restaurants are operating on a limited schedule and hotel business is affected deeply by low numbers of tourists and business events which has led to some major hotels to be temporarily closed. There will be a set-back in demand from this sector. If land border closures are enforced effectively, it could also mean less smuggled oil into the country. Smuggled goods and oils come into countries like Ghana from bordering countries such as Togo and Cote D’Ivoire. With less smuggled oil into the country, there will be a slight increase in demand for palm oil trading in those countries.

Manufacturing Sector

Moreover, panic buying has also put a strain on essential goods in the retail market temporarily. More demand for cooking oil and household products is seen due to increased buying during the lockdown. Demand for cooking oil is higher at the retail market as the pandemic situation has brought uncertainty about when livelihood will return to ‘normal’. This will be temporary pattern until panic buying reaches its plateau. This is also only applicable to middle and higher class population, which doesn’t not represent the average population of this region. Between 16 and 20th of March, South Africa saw a massive panic shopping spree while the majority of consumers do not get to fill up their carts on a regular basis, let alone during a crisis.

Economic Situation

With the current pandemic, economies around the world has been compromised. African countries are bracing to face a worse economic situation. As WHO mentioned, ‘’COVID-19 has the potential not only to cause thousands of deaths, but to also unleash economic and social devastation”. This region could face a food security crisis. World Bank predicts that the food imports will decline between 13-25% due to reduced local demand and higher cost. World bank in its latest report released on April 9, 2020, has forecasted the growth to fall from 2.4% in 2019 to between -2.1% and -5.1% in 2020, which will put Sub-Saharan Africa into recession after 25 years. The predicted fallout is influenced by many factors which also includes ‘disruption in trade and value chains affecting commodity exporters and countries with strong value chain participation’.

Conclusion

In the HORECA sector, less demand is seen in the bulk usages, that goes into restaurant and catering. Higher demand is seen in the retail market due to panic buying temporarily. Though Covid-19 related effects have not been felt immediately in a large scale, demand for palm oil will reduce substantially, as the economy in Sub-Saharan Africa will be hit hard. This will affect Malaysian palm oil imports to Sub-Saharan Africa deeply since recovery from the outcome of Covid-19 can be a rather slow process in this region.

Prepared by Karthigayen Selva Kumar, Fazari Radzi, and Iskahar Nordin

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.